Many people are concerned that their estate will face substantial taxes after they pass away, but as our Houston, TX estate tax lawyer can explain, the state of Texas actually does not have an estate tax. However, residents may still have their assets subject to such taxes at the federal level. An estate tax is when a tax gets applied to the estate of someone who died before the money gets distributed to heirs or beneficiaries. By comparison, the federal government taxes an inheritance tax after items or money has been given to the deceased’s heirs. Those who pass away in Texas won’t owe estate tax to the state, but they may have to pay the federal government. For personalized advice for how to minimize federal tax impacts to your estate, contact our team at Stuart Green Law, PLLC today.

Gift Your Assets While Alive

If you want to avoid a potentially complicated and lengthy legal proceeding for your beneficiaries or heirs after you have passed on, then we suggest meeting with our team for advice as soon as you can. You may have the option of gifting your assets throughout your lifetime as a way to avoid hefty taxation after your death. For most, is it advisable to give your assets while alive, so that you can minimize federal estate taxes and make your closest loved ones happy, since they can benefit from your gift right away. There are many ways to give assets in a tax-free way, such as:

- Giving a lifetime gift and estate tax exemption

- The annual gift tax exclusion

- Directing payments to educational and medical providers on behalf of a family member or close friend

New Tax Laws And Life Changes

After you have completed your estate plan documents and addressed your federal estate tax concerns, you may need to make edits when there are new tax laws or life changes. It is recommended that you review your estate plan periodically, particularly after any significant life changes occur. As our Houston estate tax lawyer can review with you, reasons to update your estate plan can include a divorce, marriage, or the birth of children or grandchildren. As new tax laws become an effect, it is imperative that you adjust your estate plan to reflect them. If you fail to do so, it can cause problems for your estate later on.

Stuart Green Law, PLLC

At Stuart Green Law, PLLC, we understand that what you have earned throughout a lifetime matters. Chances on, you want to see your most prized possessions and monetary funds go to those you love the most after your passing. We can set up your estate plan in a way that minimizes federal estate taxes. While Texas doesn’t have estate taxes at the state level, you will need to consider federal impacts. If you do not take the time to implement tax reduction strategies now, then it could cost your estate in the future. Please reach out to our Houston estate tax lawyer for more personalized advice and guidance.

Understanding Estate Taxes And Legal Guidance

Estate taxes can be complicated and frustrating, but your Houston, TX estate tax lawyer can help you find your next steps. At Stuart Green Law, PLLC, we specialize in providing personalized legal solutions to help individuals and families plan for the future, minimize their tax liabilities, and navigate the legal requirements of estate planning with confidence.

The Significance Of Proper Estate Planning

Effective estate planning goes beyond simply drafting a will. It encompasses a range of strategies designed to protect your assets, reduce estate taxes, and ensure the smooth transition of your estate to your beneficiaries. Without a comprehensive plan in place, your estate could be subject to higher taxes, leaving your heirs with less than you intended.

Reducing Estate Tax Liability

One of the primary objectives of estate planning is to minimize the tax burden on your estate and your heirs. There are several strategies that can be employed to achieve this, from gifting assets during your lifetime to setting up trusts that offer tax advantages. Each approach requires a deep understanding of tax laws and regulations, which are subject to change. Keeping abreast of these changes and adapting your estate plan accordingly is crucial to ensuring that your estate is as tax-efficient as possible.

Legal Expertise You Can Trust

At Stuart Green Law, PLLC, we pride ourselves on our depth of knowledge and experience in the field of estate planning and tax law. We work closely with our clients to understand their objectives, offering tailored advice and innovative solutions to meet their needs. Whether your estate is modest or extensive, our goal is to provide you with peace of mind, knowing that your estate plan is designed to protect your assets and your loved ones.

Why Choose Us For Your Estate Planning Needs

Choosing the right legal partner for your estate planning needs is critical. You need a firm that not only understands the legal landscape but also appreciates the personal significance of your estate plan. We believe your Houston estate tax lawyer should be committed to building long-term relationships with clients. Our clients appreciate our attentive service, our dedication to excellence, and our commitment to achieving the best possible outcomes for them and their families.

Taking The Next Step

If you are seeking to develop a comprehensive estate plan that addresses your concerns about estate taxes, asset protection, and the welfare of your heirs, we invite you to reach out to us. Our team is ready to assist you with every aspect of your estate planning needs, from initial consultation to the implementation of your plan and beyond. Let us help you create a lasting legacy that reflects your values and goals.

Contact Stuart Green Law, PLLC today to schedule a consultation. Together, we can explore the options available to you and develop a strategic plan that minimizes your estate tax liabilities, protects your assets, and ensures that your wishes are honored. Take the first step towards securing your legacy and providing for your loved ones with confidence and clarity. Reach out to us now to see how a Houston estate tax lawyer from our office can help.

How An Estate Tax Lawyer Can Help Reduce Taxes

As our trusted Houston, TX estate tax lawyer can tell you, navigating the complexities of estate taxes can be daunting. This is where an estate tax lawyer becomes invaluable, offering expertise to help minimize the tax burden on your estate. Stuart A. Green, the founding and managing attorney in our firm, has a passion for each client’s financial health.

- Comprehensive Estate Planning. An estate tax lawyer will work with you to create a comprehensive estate plan that addresses your unique financial situation and goals. This includes drafting wills, setting up trusts, and other essential documents. By strategically planning the distribution of your assets, you can reduce the taxable value of your estate, ensuring that more of your wealth is preserved for your beneficiaries.

- Utilizing Trusts Effectively. As our estate tax lawyer in Houston can tell you, trusts are powerful tools in estate planning. An estate tax lawyer can guide you in setting up various types of trusts, such as revocable living trusts, irrevocable trusts, and charitable trusts. These trusts can help manage your assets, provide for loved ones, and significantly reduce estate taxes. For example, irrevocable life insurance trusts (ILITs) can remove life insurance proceeds from your taxable estate, potentially saving substantial amounts in taxes.

- Maximizing Exemptions and Deductions. Understanding and maximizing the use of available exemptions and deductions is critical in estate tax planning. An estate tax lawyer will ensure you take full advantage of the federal estate tax exemption, which allows a certain amount of your estate to be passed on tax-free. Additionally, they can help you leverage marital deductions, charitable deductions, and other tax-saving opportunities to minimize your estate’s taxable value.

- Strategic Gifting. Gifting assets during your lifetime is an effective strategy to reduce the size of your taxable estate. An estate tax lawyer can advise you on the best ways to gift assets, utilizing annual gift tax exclusions and lifetime gift tax exemptions. By strategically gifting assets, you can lower the value of your estate and potentially reduce estate taxes while seeing your loved ones benefit from your generosity.

- Business Succession Planning. If you own a business, planning for its succession is crucial to avoid significant estate taxes. An estate tax lawyer can help you design a succession plan that transfers ownership smoothly and tax-efficiently. This might involve setting up family limited partnerships (FLPs) or using valuation discounts to lower the business’s taxable value. Effective business succession planning ensures your business continues to thrive while minimizing the tax impact on your estate.

- Staying Updated on Tax Laws. Estate tax laws are complex and frequently change. An estate tax lawyer stays current with the latest tax laws and regulations, ensuring your estate plan remains compliant and optimized for tax savings. They can adjust your estate plan as needed to take advantage of new tax laws or to protect against unfavorable changes, providing peace of mind that your estate is well-managed.

- Resolving Disputes and Handling Audits. In the event of disputes or audits by the IRS, an estate tax lawyer provides crucial representation and expertise. They can handle negotiations, represent you in court if necessary, and work to resolve any issues favorably. Their experience in dealing with tax authorities can help protect your estate from unnecessary tax liabilities and penalties.

Help With Your Estate Taxes

At Stuart Green Law, PLLC, we are committed to helping you navigate the complexities of estate taxes. Before founding his firm, attorney Stuart A. Green, worked at Ernst & Young, LLP dealing with diverse tax issues. Our experienced team can develop a tailored estate plan that reduces your tax burden and ensures your legacy is preserved. Contact our Houston estate tax lawyer today to schedule a consultation and take the first step toward securing your estate’s future.

Houston Estate Tax Infographic

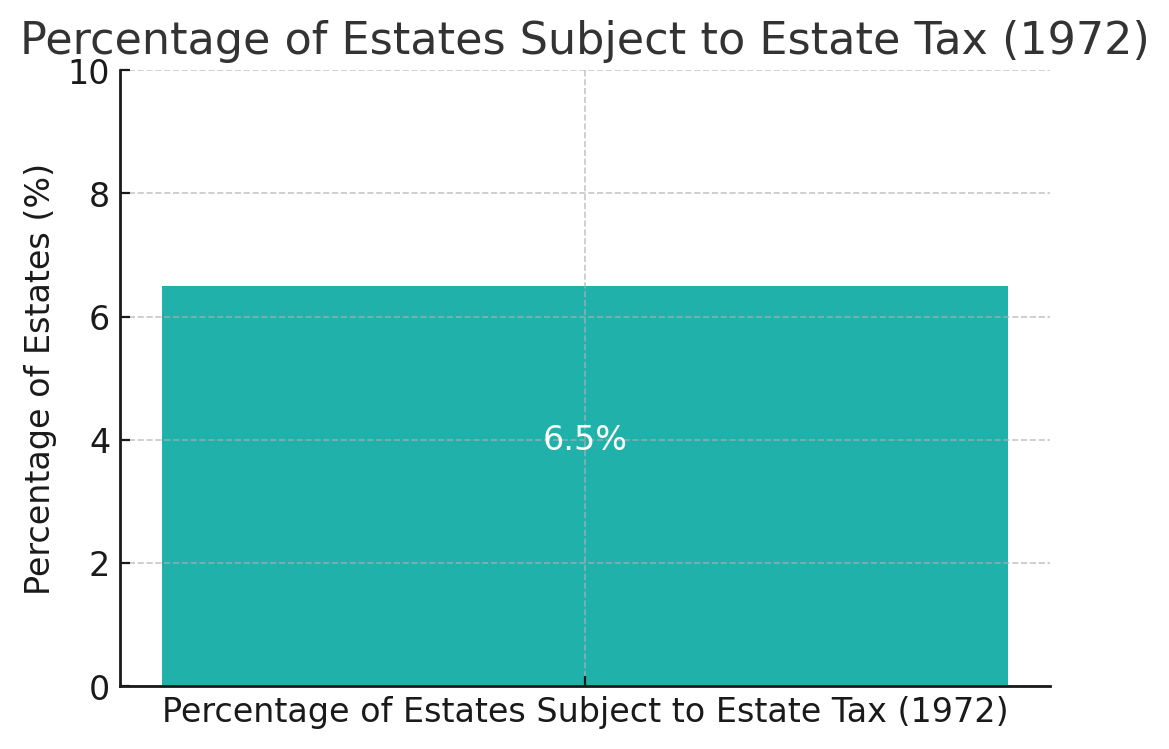

Houston Estate Tax Statistics

Estate tax statistics reveal a significant reduction in the number of estates subject to federal taxation over recent decades. In 1972, approximately 6.5% of decedents’ estates were liable for estate taxes. By 2021, this figure had plummeted to less than 0.1%, with only about 2,584 estates paying the federal estate tax .

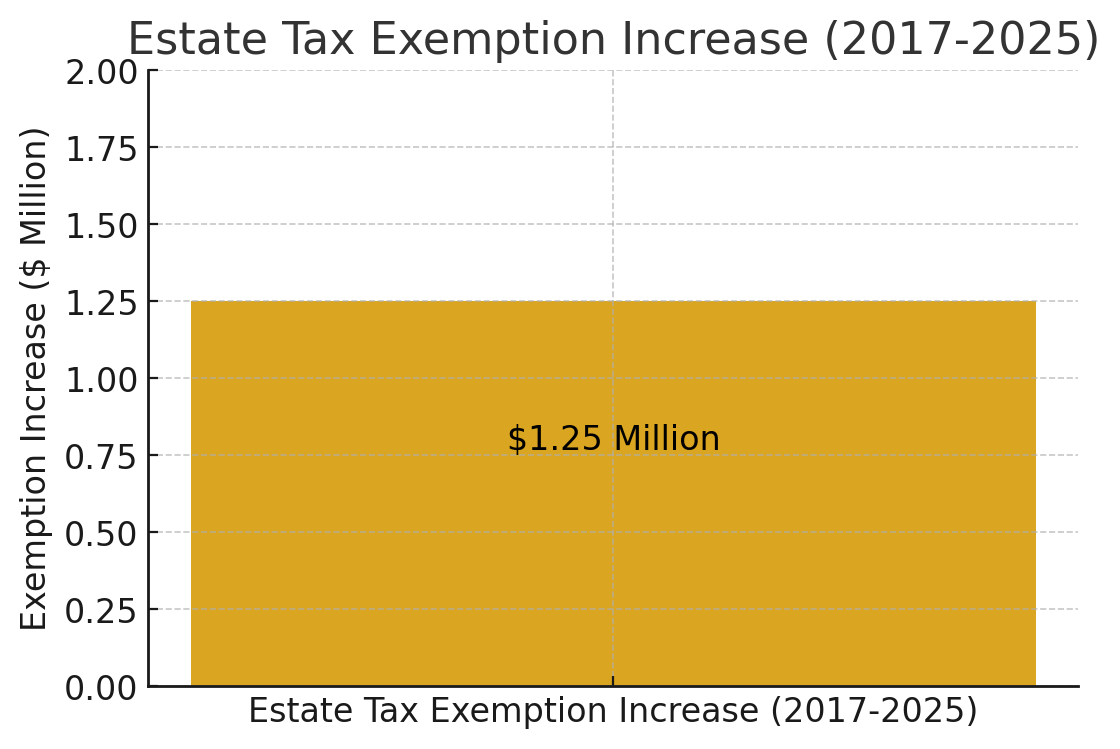

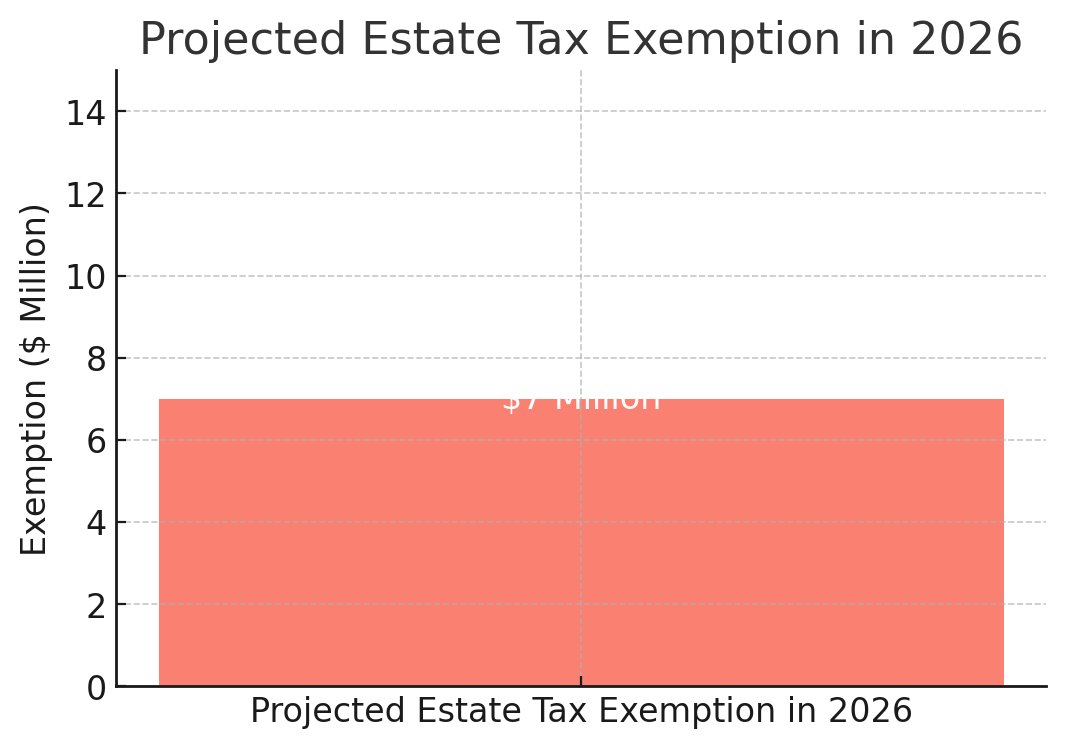

This decline is primarily due to substantial estate tax exemption threshold increases. For instance, the Tax Cuts and Jobs Act of 2017 raised the exemption from $5.49 million in 2017 to $11.18 million in 2018. As of 2025, the exemption stands at $13.99 million per individual, or $27.98 million for married couples. If no legislative action is taken, this exemption is set to revert to approximately $7 million per individual in 2026.

Strategic Gifting To Reduce Tax Burdens

Our Houston, TX estate tax lawyer understands that when you want to reduce your tax burdens, there are several strategies you can take. Attorney Stuart A. Green is the founder of Stuart Green Law and can help you with your tax needs.

What Is Strategic Gifting, And How Can It Help Reduce Estate Taxes?

Strategic gifting involves transferring assets to your heirs during your lifetime to reduce the value of your estate and, consequently, the estate taxes owed upon your passing. By utilizing annual gift tax exclusions and lifetime gift tax exemptions, you can effectively decrease your estate’s taxable amount. An estate tax lawyer can guide you through this process, ensuring you maximize the benefits of these gifting strategies while remaining compliant with tax laws.

How Does The Annual Gift Tax Exclusion Work?

The annual gift tax exclusion allows you to give a certain amount to any number of individuals each year without incurring gift taxes. For example, in 2024, the exclusion amount is $17,000 per recipient. By making use of this exclusion, you can transfer significant wealth over time without affecting your lifetime gift tax exemption. An estate tax lawyer in Houston can help you plan these gifts strategically to maximize tax savings and reduce your overall estate tax liability.

What Is The Lifetime Gift Tax Exemption, And How Does It Impact Estate Planning?

The lifetime gift tax exemption is the total amount you can give away during your lifetime without incurring gift taxes. As of 2024, the exemption amount is $12.92 million per individual. Gifts that exceed the annual exclusion count against this lifetime exemption. By carefully planning your gifting strategy, an estate tax lawyer can help you use this exemption to reduce the size of your taxable estate, thereby lowering the estate taxes your heirs will owe.

Can Strategic Gifting Include Non-cash Assets?

Yes, strategic gifting can include non-cash assets such as real estate, stocks, or other valuable property. These types of gifts can be more complex to value and transfer, but they offer significant opportunities to reduce your taxable estate. Working with a lawyer ensures that these transactions are handled correctly, taking into account any potential capital gains tax implications and ensuring compliance with IRS regulations.

How Can Your Lawyer Assist With Strategic Gifting For Estate Tax Planning?

At Stuart Green Law, PLLC, we specialize in helping clients navigate the complexities of estate tax planning, including strategic gifting. Our experienced estate tax lawyers will work with you to develop a personalized gifting strategy that aligns with your financial goals and reduces the tax burden on your heirs. We offer comprehensive guidance on utilizing annual exclusions, lifetime exemptions, and gifting non-cash assets, ensuring that you maximize the benefits of these strategies while adhering to all legal requirements.

Houston Estate Tax Glossary

At Stuart Green Law, PLLC, we are committed to helping clients in Houston, TX, understand the legal and tax implications of estate planning. Below, we provide definitions and context for five essential terms related to estate taxes and planning, tailored to our clients’ needs.

Estate Tax

An estate tax is a federal tax levied on the total value of a person’s estate after their death and before it is distributed to heirs. This includes cash, real estate, investments, and other valuable assets. While Texas does not impose a state estate tax, the federal government applies taxes to estates that exceed the exemption threshold. For 2024, this exemption is $12.92 million per individual, and any value above this amount is taxed at rates up to 40%. For example, a Houston resident with an estate valued at $15 million would face federal estate taxes on $2.08 million if no planning strategies were implemented. Tools such as irrevocable trusts or gifting can significantly reduce the taxable value of an estate, helping ensure more wealth passes to heirs rather than being paid in taxes.

Lifetime Gift And Estate Tax Exemption

The lifetime gift and estate tax exemption is a combined federal allowance enabling individuals to transfer wealth either during their lifetime or upon death without incurring taxes up to a set amount. This exemption is essential in high-net-worth estate planning, as it lets individuals decide how much to gift during life versus how much to leave behind. For instance, if a Houston entrepreneur gifts $3 million during their lifetime, they retain a $9.92 million exemption to shield their remaining estate. This strategy can be especially advantageous for reducing estate taxes while also witnessing the positive impact of gifts, such as funding a loved one’s education or a family business.

Annual Gift Tax Exclusion

The annual gift tax exclusion permits individuals to give up to a specified amount to any number of recipients each year without reducing their lifetime exemption or triggering gift taxes. For 2024, the exclusion amount is $17,000 per recipient. This exclusion offers a simple yet powerful way to transfer wealth incrementally over time. For example, a Houston couple with three children and four grandchildren could gift up to $238,000 annually ($17,000 per recipient multiplied by seven recipients). Over several years, this strategy can significantly reduce the taxable estate while providing meaningful financial support to loved ones.

Marital Deduction

The marital deduction allows spouses to transfer an unlimited amount of assets to each other tax-free, either during their lifetimes or upon death. This provision is a cornerstone of estate planning for married couples, as it defers federal estate taxes until the death of the surviving spouse. For example, a Houston spouse may pass a $20 million estate to their surviving spouse tax-free, regardless of the federal exemption limits. However, it’s essential to plan for the ultimate taxation of the estate upon the second spouse’s death. Utilizing tools such as a credit shelter trust or qualified terminable interest property (QTIP) trust can help manage this eventual tax burden while preserving assets for the next generation.

Irrevocable Trust

An irrevocable trust is a legal structure designed to hold and manage assets outside the grantor’s estate, making it a valuable tool for reducing estate taxes, protecting assets, and ensuring long-term financial security for beneficiaries. Once assets are transferred to an irrevocable trust, they are no longer considered part of the grantor’s taxable estate, though the grantor also loses control over those assets. For instance, a Houston resident might establish an irrevocable life insurance trust (ILIT) to exclude the proceeds of a life insurance policy from their estate, potentially saving millions in taxes. Similarly, a charitable remainder trust can provide income to the grantor during their lifetime while benefiting a chosen charity after their death, offering tax advantages and supporting philanthropic goals.

Find Trusted Help Now

Strategic gifting is a powerful tool for reducing estate taxes and preserving your legacy for future generations. By partnering with an estate tax lawyer, you can navigate the complexities of tax laws and ensure your estate plan is both effective and compliant. Before founding his own law firm, attorney Stuart A. Green gained tax expertise by working at Ernst & Young, LLP. If you’re ready to explore how strategic gifting can benefit your estate plan, contact Stuart Green Law, PLLC today to schedule a consultation. Let us help you secure a brighter financial future for your loved ones. Speak with our Houston estate tax lawyer now.

Client Review

“Great guy – honest businessman. Has been very helpful for me in providing feedback and input from a law perspective on employment and legal agreements in my personal and professional life. Would heartily recommend Stuart to others!”

Joseph Marchetti